One of the great things about Site Meter is that it tells you how people find their way to your blog, i.e., 'referrals.' If they started with a Google search, Site Meter reveals the query that led them to Shoester.

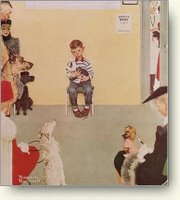

So I was peeking at the referrals this morning, and yesterday, someone wandered over by way of a Google search for "Are my dog's medical expenses a tax write off?" I'm not a tax lawyer, and I don't want to give legal advice via Blogger, but no, you cannot take a deduction for veterinarian bills. Or bad haircuts.

For some reason, though, there is a deduction for gambling losses. Isn't that odd? I can't deduct the $10 I spent to see Basic Instinct 2, but the old lady who spends an hour feeding a bag of quarters to a slot machine can deduct every quarter that's a loser. On the other hand, if she wins, she has to report it as income. So it's treated like an investment.

I didn't look very hard for figures, but the Center for Responsive Politics has a couple paragraphs about this one. Snip:

The Treasury estimates that in 1995, more than 1,500 millionaires using the gambling deduction cost the government $377 million in tax revenue.

Tax deductions really boil down to subsidies; they're incentives (some more effective than others) to do something, or not to do something, with your money. Why do we subsidize gambling?

1 comment:

I wonder ... is Life Insurance considered a gambling cost? I mean, you are betting on your own demise, right? Death and taxes ... it all there.

Post a Comment